Strategy, Legal & Operations

Acronymed out? Here’s what the PCAF’s carbon accounting rules mean

When former Governor of the Bank of England, Mark Carney, warned that global financials were systemically peddling the world’s most carbon-heavy projects, the paving for the Partnership for Carbon Accounting Financials (PCAF) was laid.

“To achieve net-zero, we need a whole economy transition–every company, every bank, every insurer, and investor will have to adjust their business models, develop credible plans for the transition and implement them. For financial firms, that means reviewing more than the emissions generated by their own business activity. They must measure and report the emissions generated by the companies they invest in and lend to.”

—Mark Carney, as the Prime Minister’s Finance Adviser for COP26 and observer to PCAF.

What is the Partnership for Carbon Accounting Financials?

Originating with the Dutch in 2015, the PCAF is touted as a collaborative effort born out of the finance industry to enable asset managers and owners, banks, and insurers to measure and disclose carbon emissions.

But crucially, not the emissions from their own business activities, but those associated with their lending, insuring, and investment activities.

The PCAF launched the Global Greenhouse Gas Accounting and Reporting Standard for the Financial Industry to facilitate transparency and accountability of financial institutions to scientifically-founded targets, to align their portfolios to the Paris Agreement.

The standard is endorsed by the Greenhouse Gas (GHG) Protocol—the most widely used greenhouse gas accounting standards.

The GHG protocol (and indeed the Taskforce for Climate-related Financial Disclosure) advises the marketplace of the steps it should take to assess these emissions—tangible impact-data points are where the PCAF comes in.

It provides a practical method of implementation—fundamental accounting methodologies to standardise emissions-measurement approaches specifically for financial institutions.

Which is arguably, the most crucial step in ensuring that every financial decision takes climate change into account.

The impressive uptake is encouraging and will likely only grow further as more central banks and governments continue to make carbon-emission disclosures mandatory for the near future.

At the time of writing, the initiative has more than 150 signatories from major global financial institutes, representing over 50 trillion USD in impactful assets.

How does the PCAF standard work in practice?

The PCAF has provided the standard as open-source datasets, specific to financial institutions so that each party uses consistent information for calculating the emissions associated with different asset class.

This permits the attribution of emissions from holdings or loans to other organisations as well as investments in significant properties or projects.

Yet, the standard doesn’t prescribe each and every data point to be used—and this is deliberate. Instead, it provides the accounting methodology and shares best practice in using proxy and external data sources.

Crucially, the PCAF understands that the method requires stringent uniformity, but—and this is the key to the partnership—not so far as to stifle sector-specific nuances by those who understand them best of all.

Whilst all are classified as financial institutions—insurers, investors, and banks deploy capital in quite different ways.

And so, insight into the art of accounting these distinctions is fed back into the working group to continue improving the methodology and guidance for both accuracy and practicality.

The methodology currently covers the asset classes depicted below, the classifications of which are aligned to the EU Sustainable Finance Taxonomy.

This makes the PCAF standard as consistent and widely relevant as possible.

The partnership continues to work to add additional asset classes to the methodology as we speak, increasing the proportion of the market able to participate with each release.

How does the PCAF fit into wider carbon accounting?

As Mr Carney says, once financial emissions are measured, they prove their value to the market once publicly reported (and no, that doesn’t mean being filed away in a dark, Corporate Responsibility corner of a company’s website).

As we’ve explored, the UK treasury has stipulated that the TCFD guidance will become mostly mandatory by 2023 and fully by 2025.

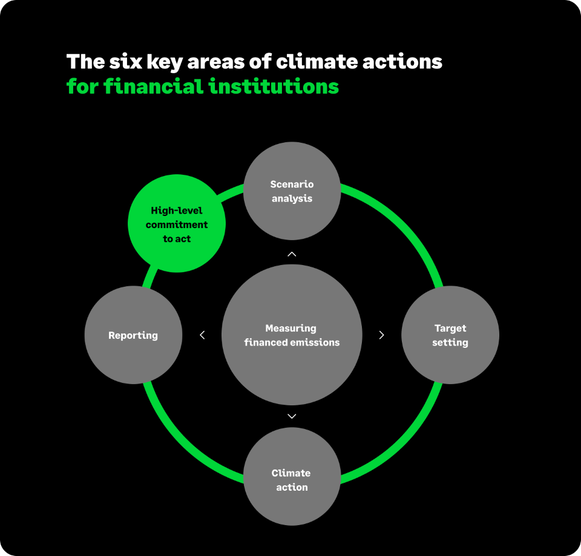

So, as displayed below, these PCAF calculations will be the critical foundation in making those disclosures and other climate actions possible.

Measuring the finance emissions of a portfolio of investment or loans is core in enabling financial institutions to perform:

- scenario analysis

- target setting

- disclosing progress reports (to the TCFD and industry stakeholders alike)

and, of course, taking real action to reach net-zero.

Best practice between participants of the PCAF: data, process and culture

The PCAF is fully funded by philanthropists and thus free for financials to join. As with many data-garnering initiatives—the measurements are only as good as those being inputted.

The PCAF is aware that the process to iterate and share best practice is a valuable one and so permits the use of low-level estimates in the first release.

This enables participants to identify the gaps in both their output and process and then improve upon each with every disclosure.

And hence the inclusion of a data- quality score—whereas, if complete accuracy were mandated, fewer signatories would be probable, and those participating would likely be doing so as a virtue-signal exercise over a genuine commitment to change.)

The collaborative nature of the PCAF also promotes the waves of culture change to disperse to all areas of the financial institution involved in pulling the submissions together.

That is, a climate-related mindset will be encouraged throughout these financial institutions, not just of the output they produce each year.

Try our solution to answering the calls of financial transaction environmental transparency

The Sage Earth carbon accountability platform provides a practical solution to help you to collect the business data needed to make such calculations and disclosures.

For business, the tool quickly and easily links up to your accounting software (or raw data) —this spend data is combined with our extensive carbon intensity database to convert pounds spent with a merchant into an estimated carbon-dioxide equivalent (see methodology here).

We then take these data points and build them up in layers of increasing detail. Throughout the process, the tool seeks to add accuracy, completeness, and specificity to your emissions estimate.

The software fills in gaps using accredited external data sources, enabling your organisations to not only adhere but act on the insight gained throughout the process.

For asset managers, banks, insurers, and the like, the platform can operate as a catch-all reporting dashboard.

The data, measured using the above methodology for each business in the portfolio, sits within a centralised Sage Earth reporting database allowing you, to take stock of your risk and opportunity areas.

Want to know more about how Sage Earth can help you? Drop your question in the chat or email us directly.

Did you know that Sage has a new Carbon Accounting software solution?

If you use either Sage Business Cloud Accounting or Sage 50, Sage Earth can help you better understand your business's environmental impact and guide you to net zero emissions.

Ask the author a question or share your advice